Related Resources

On May 6, 2019, the Centers for Medicare & Medicaid Services (CMS) issued the Reassignment of Medicaid Provider Claims Final Rule (CMS 2413-F) to rescind 42 C.F.R § 447.10(g)(4) regarding a state’s ability to reassign or divert certain provider reimbursement to third parties. More specifically, CMS removed the regulatory text at 42 C.F.R § 447.10(g)(4) because it granted permissions to states that Congress has foreclosed. The rescission took effect on July 5, 2019.

On September 13, 2019, the Center for Medicaid & CHIP Services (CMCS) issued an Informational Bulletin (PDF, 233.76 KB) to remind states of the rescission of 42 C.F.R. § 447.10(g)(4).

Section 1902(a)(32) of the Social Security Act provides for a number of exceptions to its direct payment requirement, but the statute does not authorize the Agency to create new exceptions. This direct payment requirement and its exceptions are implemented in regulations at 42 C.F.R § 447.10. The former regulatory exception at §447.10(g)(4) is not authorized in the statute, and thus it has been removed from the regulations due to its lack of statutory authority. The rescission of §447.10(g)(4) does not affect agency-provided services rendered by employees receiving salaries/wages from the agency; however, it does affect the class of practitioners for which the Medicaid program is the primary source of service revenue and receive payment from the state. Effective July 5, 2019, any state that previously reassigned portions of a provider’s payment to third parties under §447.10(g)(4) must discontinue this practice.

CMS created a Provider Reassignment Regulation mailbox to accept questions, comments, and complaints/grievances regarding state compliance with the rescission of §447.10(g)(4) or impermissible withholdings. Any questions, comments, and complaints/grievances can be sent to: ProviderReassignment@cms.hhs.gov.

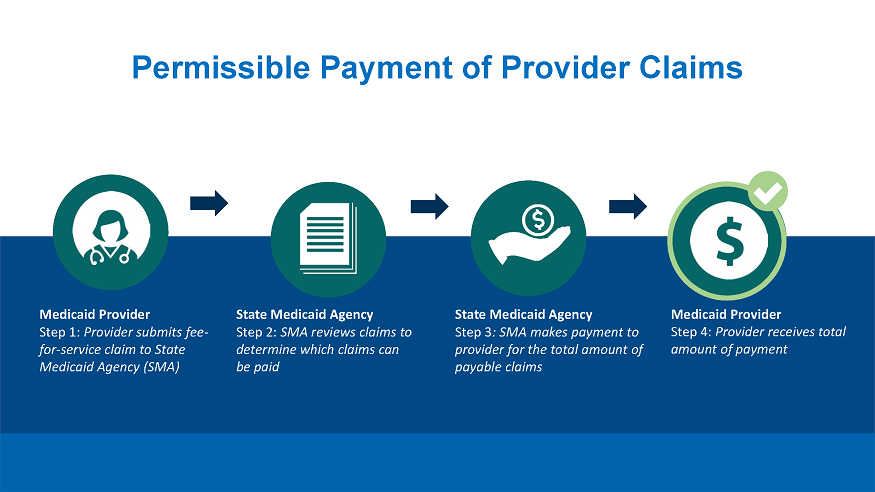

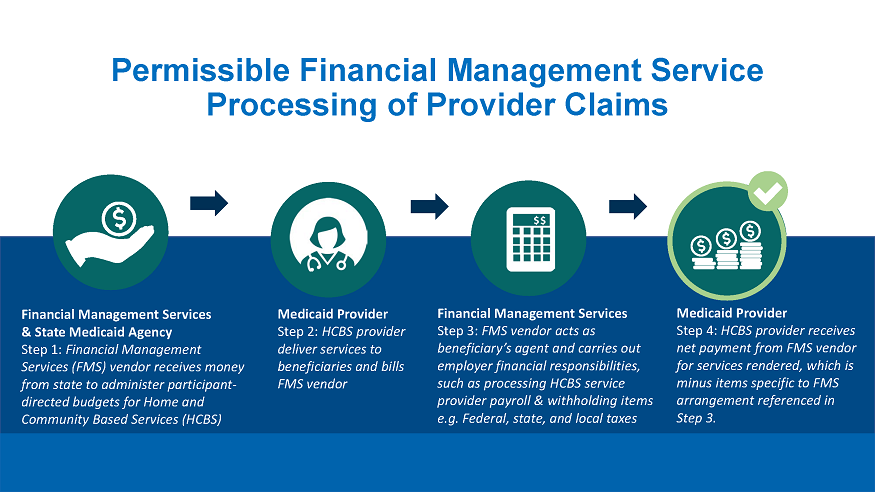

Below are illustrations of provider claims/reimbursement: